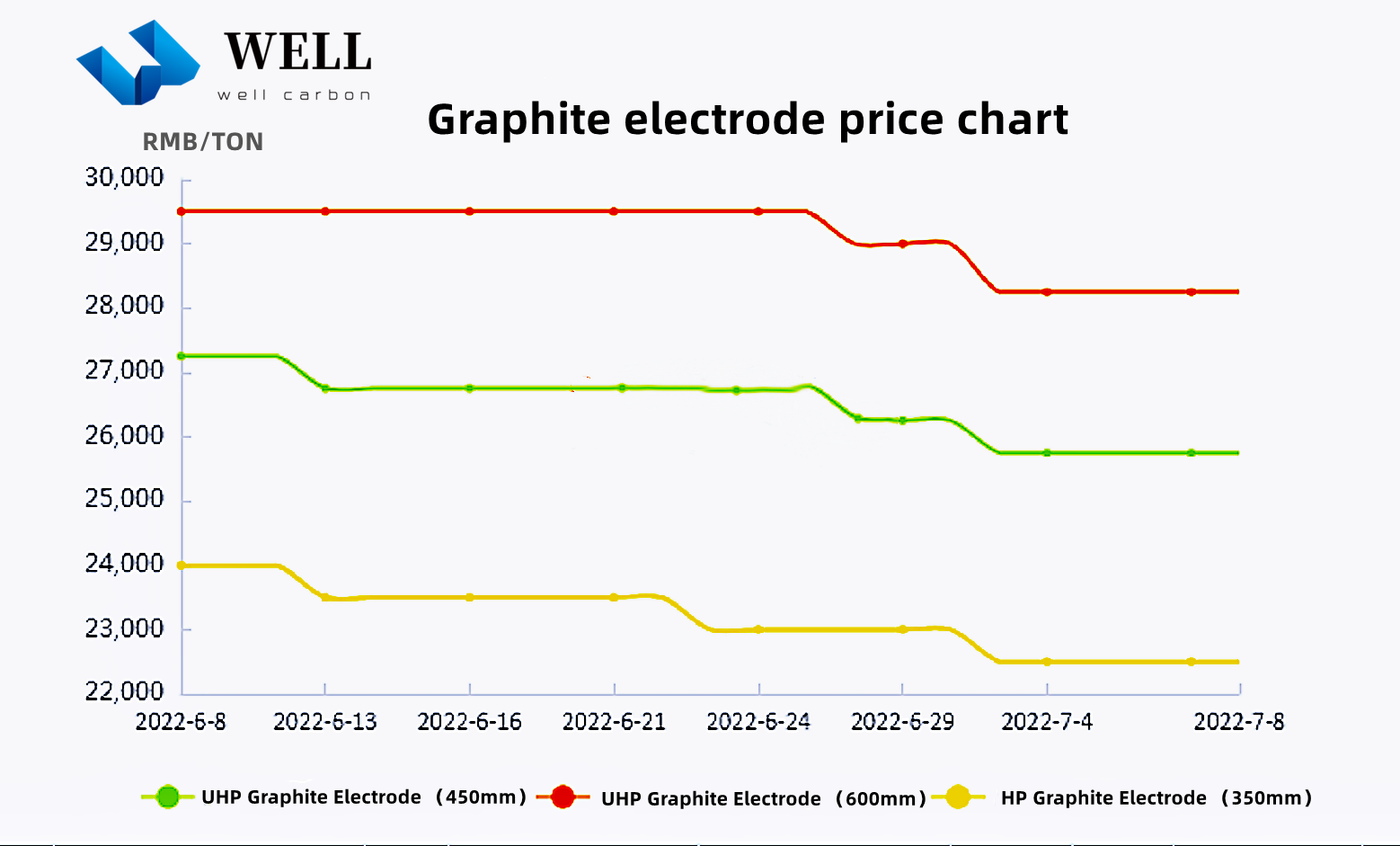

This week, the average weekly price of China's graphite electrode (450mm: high power) market was 23,250 yuan/ton, down 1.69% from last week, and the mainstream price was stable at 22,500-24,000 yuan/ton.

This week, the average weekly price of China's graphite electrode (450mm ultra-high power) market was 25,750 yuan/ton, down 1.90% from last week, and the mainstream price was stable at 25,000-26,500 yuan/ton.

The price of graphite electrodes remained stable this week. After the previous price reduction, the market is currently in a wait-and-see attitude. The superimposed raw material end of the petroleum coke has returned to the upward trend, and the company's willingness to continue to reduce prices is relatively limited. In terms of raw materials, petroleum coke has performed well this week. At the beginning of the month, downstream carbon enterprises were active in purchasing, and the trading performance was active. The quotations of refineries were also raised. In terms of coal tar pitch, as the cost increased, the supply declined, and corporate confidence gradually increased. At present, the consumption performance is average. The lower quotation remained stable, but the price rose in the later period; the needle coke maintained a high and firm market; overall, the raw material side provided strong cost support for the electrode price. Downstream steel mills are still operating at a weak level, and companies that are not operating well in the industry are also less motivated to produce. In the case of production stoppage and promotion, the consumption of graphite electrodes is bad. The current market transactions are mainly based on a small amount of rigid demand, and the overall transaction performance continues the previous deserted trend.

In the short term, electrode prices may remain stable. The trend of raw material costs is stable and strong, the cost side once again supports the electrode market, and the quotations of enterprises may continue to decline, but the downstream consumption performance continues to be weak, the steel market has not improved, and the electrode consumption performance continues to be deserted, lacking upward momentum.